$50 million federal grant boosts Port Wilmington expansion project

| December 11, 2023

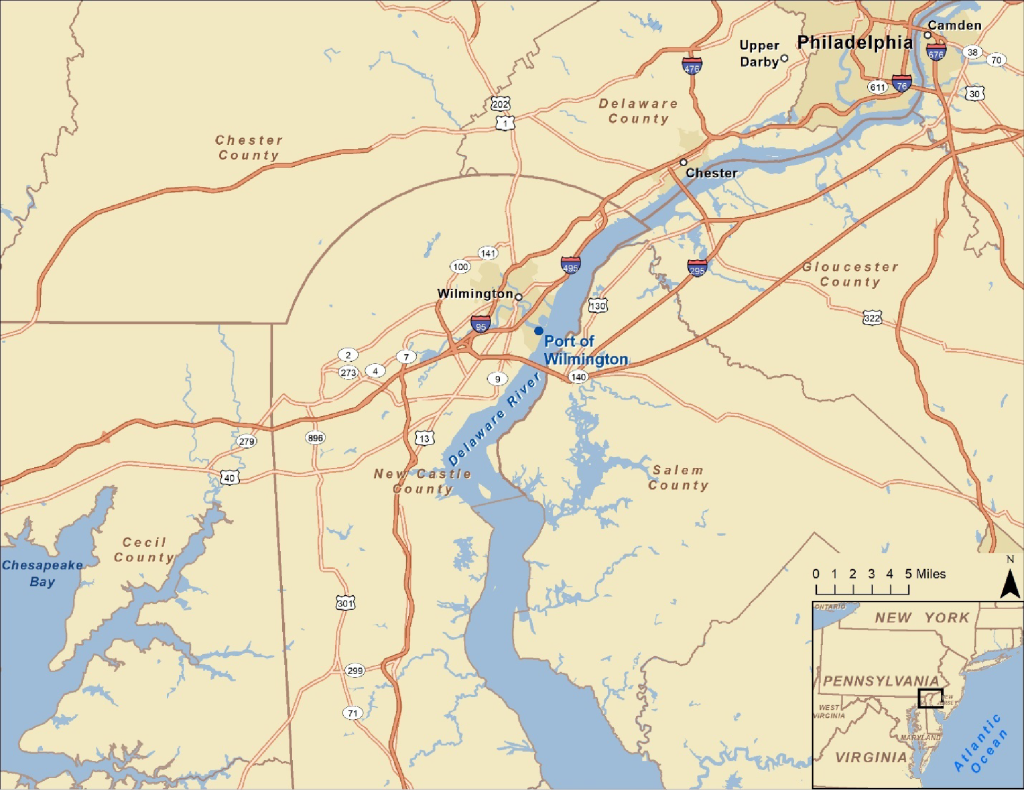

The much-discussed-and-delayed plan to expand Port Wilmington by turning the former Edgemoor titanium dioxide manufacturing site into a new, modern container terminal on the Delaware River’s west bank has gotten a significant boost with a $50 million federal grant.

Diamond State Port Corp., which owns the port and the Edgemoor site, received the grant under the Port Infrastructure Development Program, which is part of the Bipartisan Infrastructure Law, in a competitive selection process that supports projects that “improve the safety, efficiency or reliability of the movement of goods into, out of, around, or within a port,” Gov. John Carney of Delaware said in announcing the grant in November.

Carney said the grant would “help make the planned Edgemoor expansion a reality and bring new good-paying, full-time union jobs to Wilmington and the region.”

The expansion plan includes the construction of a container yard featuring all-electric operations and a new truck gate.

The award follows a sudden change of course for the port with the departure at the end of July of GT USA Wilmington as the port operator, which made modest progress on the Edgemoor plan.

Diamond State instead signed a new contract with Enstructure, a marine terminal and logistics company based in Wellesley, Mass., that has facilities across the Central United States and Eastern and Gulf Coast regions.

Under the agreement, Enstructure agreed to invest up to $65 million in the port.

The Edgemoor development is a key part of Delaware’s ambition to make Port Wilmington a major contender in the East Coast battle for container trade.

The existing port facilities, most of which sit on the Christina River, are limited by the shortfall in water depth and a lack of space on which to create the vast warehouse and container storage space necessary.

But the Edgemoor site potentially has deep water and enough space to develop the container storage areas and warehouses needed to prepare Port Wilmington to handle far larger vessels.

“This money will help Delaware finance the construction of a new terminal,” Jeff Bullock, the chairman of Diamond State, said in a statement. “We will work with the Edgemoor community, the port operator, Enstructure, and our partners in organized labor to make sure we succeed.”

New port rising

If they do succeed, it will defy the port’s recent history.

GT USA Wilmington, a U.S. division of Gulftainer, a global port and logistics company based in the Middle East, operated Port Wilmington under a 50-year agreement signed with Diamond State in 2018.

The agreement included a commitment by GT USA Wilmington to make investments in the existing facility and the Edgemoor project that Diamond State estimated at $580 million in its 2022 annual report.

Among the required investments outlined in the contract was $40 million to be spent on the existing port. The contract also required GT USA Wilmington to spend $250 million to develop the Edgemoor site, and another $100 million in warehouse improvements at both sites.

Read more: The Delaware River, already a major route for cargo, is poised to become even more competitive

However, the 2022 Delaware State Freight Plan reported that at that time the port operator had only spent $118 million to upgrade the port since the two sides inked the deal.

At its signing, the agreement was seen by Delaware as potentially the trigger to the rise of a new container terminal on the river that could draw business from other ports on the coast, including the far larger Port of Philadelphia, known as PhilaPort, which is 30 miles more distant from the sea.

Port Wilmington handles about 215,000 20-foot equivalent unit containers, the industry metric for measuring container volumes, according to the port website. That’s about one-third of the container volume that PhilaPort does.

But the development of the Edgemoor facility would add capacity of 1.2 million TEUs to Port Wilmington, according to the 2022 Delaware State Freight Plan.

The plan estimated the cost of the expansion project at $525 million, and said Delaware aimed to have the new port operational by 2025.

While a hefty figure, that investment has the potential to enhance the power of a port that already plays a significant role in the area economy.

According to Diamond State’s strategic master plan, the Port of Wilmington supports over 4,000 jobs annually, generates nearly $340 million in business revenue, more than $300 million in personal revenue, and $31 million in state and regional taxes.

The $50 million investment will create jobs and further boost that economic power, Jim Maravelias, president of the Delaware State AFL-CIO, said in a statement.

“This is putting Delaware on the map as a shipping receiver and sender in the region,” he said.

Deepening the channel

Both PhilaPort and Port Wilmington hoped to benefit from the dredging of the river’s main channel, which the U.S. Army Corps of Engineers completed at the end of 2022.

The dredging added five feet in draft depth to the river — taking it to 45 feet, deep enough to allow some of the largest container ships in the world to navigate the river.

That would make it a much more viable route for major vessels that bring cargo from China and the Far East through the Panama Canal to East Coast ports, including PhilaPort, which says it can now handle vessels as large as 14,000 TEUs.

The 38-foot depth limit of berths at Port Wilmington, however, limits the size of the vessels they can handle.

Nevertheless, Port Wilmington is a contender.

With more than 300 acres of space and warehouse storage of over 1 million square feet, the port has a strong focus on importing refrigerated goods and fruit and vegetable imports through its 4,500-square-foot berthing area.

The port is the mid-Atlantic distribution hub for Dole Fresh Fruit Company and Chiquita Fresh North America, a status that has helped position it — according to the port website — as the “#1 banana port in North America.”

Aside from bananas, the port’s major cargo sectors include petroleum products, industrial salt and petroleum coke, according to the state freight plan.

A new beginning

Diamond State purchased the 87-acre Edgemoor site in 2017, seeing in it the chance to build a facility that could compete with other East Coast ports by building a new terminal with a 2,600-foot wharf to handle containers.

Under the plan, the berth would be excavated to match the soon-to-be dredged 45-foot depth of the main channel.

Chemours Co., a spinoff of DuPont, had manufactured titanium dioxide — which is used in industrial and consumer products such as paints, coatings, adhesives, paper and plastics — at the site until it closed in 2015.

At the time, the manufacturer said the paper industry’s use of the titanium dioxide produced at the site had “declined steadily for years, with an accompanying slowdown in demand that has resulted in underused capacity at Edgemoor.”

The plant’s excess capacity kept “it from being cost-effective,” while plants in Mississippi, Tennessee, Mexico and Taiwan enjoyed “industry-leading productivity,” the company said.

For Diamond State, the site’s legacy use as an industrial hub meant it had considerable benefits for the future: The site already had “car, truck, and rail access for moving people, raw materials, wastes, and finished products,” according to the Edgemoor expansion environmental assessment.

“The purpose of this project is to modernize the State of Delaware’s international waterborne trade capabilities,” the assessment said.

That would also “allow for the State of Delaware port to remain competitive within the Delaware River international trade market, meet the rising demand for modern containerized ports, and to continue, and strengthen, waterborne trade’s importance to the State of Delaware and regional economy.”

![DC_Image [Image 4_Assunpink Meets Delaware] meets Delaware The Assunpink Creek on its its way to meet the Delaware River. The creek passes through woods, industrial and commercial areas and spots both sparkling and filled with litter.](https://delawarecurrents.org/wp-content/uploads/bb-plugin/cache/DC_Image-4_Assunpink-meets-Delaware-1024x768-landscape-14f069364113da5e8c145e04c9f2367c-.jpg)