Is this the beginning of the end for Gibbstown LNG project?

| November 30, 2021

For our complete coverage of the Wyalusing, Pa./ Gibbstown, N.J. LNG project, please click here.

Breaking news: Since the time of publication of this story, the Pipeline and Hazardous Materials Safety Administration confirmed that it has, in fact, received a renewal application for the special permit to allow the transportation of LNG by rail for the Wyalusing-to-Gibbstown project.

The application was received on Tuesday, the day the permit was set to expire.

However, as Delaware Currents has reported in the story below, federal rules require a special permit holder seeking an extension to file the required paperwork at least 60 days before the permit’s expiration date. The mere application for a renewal is no guarantee it will be approved and the application will now undergo scrutiny by the PHMSA that could take weeks or months.

Read the full story below for the full background.

Could it be the end of the line for a contentious plan to process liquified natural gas at a Pennsylvania plant and then transport it by rail to a port on the Delaware River in New Jersey?

A special permit issued by federal regulators in 2019 allowed a subsidiary of the project’s sponsor, New Fortress Energy, to ship as much as 3 million gallons of LNG per day via specialized rail tankers nearly 200 miles from Wyalusing, Pa., to a port in Gibbstown, N.J.

However, that permit – which was a major component of the company’s overall plan – is set to expire today and New Fortress has offered no indication that it plans to renew it. That raises significant questions – again – about the future of the project, which has drawn broad opposition to so-called “bomb trains” carrying highly flammable LNG through populated areas.

As Delaware Currents has reported in the past, the LNG export plan has faced a host of political, regulatory, legal and economic headwinds that have called the project’s viability into question.

Whether the expiration of the special permit signals the beginning of the end of the Wyalusing-to-Gibbstown plan, is merely a small setback or whether the plan becomes a “zombie project” – one that in the future is resurrected after it appeared to have been dead – is unclear.

Representatives for New Fortress did not respond to emails seeking comment. A leading opponent of the project said it was too early to size up its future prospects.

“I don’t like to prognosticate on the project while it is still very much alive,” said Tracy Carluccio, deputy director of the Delaware Riverkeeper Network, which has mounted various legal and procedural challenges to the project. “It’s relatively easy to be a Monday morning quarterback and analyze the trajectory of a project on a Monday, but for the proposed Gibbstown LNG export terminal, it just isn’t Monday morning yet.”

She said NFE still has various options, including relying on trucks to transport the LNG or seeking an extension of the special permit.

Under federal rules, a special permit holder seeking an extension is required to file the required paperwork at least 60 days before the permit’s expiration date. Delaware Currents confirmed earlier this month with the permitting agency, the Pipeline and Hazardous Materials Safety Administration, that no renewal had been filed.

The rules do allow an applicant to seek a renewal after a special permit has expired but merely applying is no guarantee that it will be extended. Special permit renewals can be granted for up to four years and the amount of time it takes to review applications can vary.

The PHMSA “reviews each application to ensure compliance with hazardous materials regulations, including verifying the applicant’s fitness,” according to the agency. “This can take days, weeks, or months, depending on a variety of factors.”

The proposed LNG project would start with fracked natural gas being piped via an interconnection from the Marcellus shale region of Pennsylvania to a plant in Wyalusing, Pa., about 50 miles northwest of Scranton.

The plant would liquefy the gas by cooling it to 260 degrees below zero, and then send it by truck and rail to a port in Gibbstown, N.J., which is southwest of Philadelphia. From the port, the LNG would be shipped via the Delaware River to overseas markets. The project would have an average daily production capacity of 3.6 million gallons.

The company has said in previous public filings that it expected the $800 million project to be operational in the first quarter of 2022 but as time has gone by, that seemed increasingly less likely.

Recent New Fortress filings to the Securities and Exchange Commission include language about the potential risks the company faced with its proposed Pennsylvania plant but shed little light about its future.

Through Sept. 30, 2021, the company reported having spent about $128 million on the Wyalusing facility. The filing noted that New Fortress has “not issued a final notice to proceed to our engineering, procurement and construction contractors” and that it had “repurposed” approximately $17 million of engineering and equipment to another company project.

“There can be no assurances that we will complete” the Wyalusing site, the filing said.

Routes mapped by opponents of the plan show that various paths could potentially cut through as many as 18 Pennsylvania and New Jersey counties,15 of them in the Delaware River watershed.

The project would include as many as 100 LNG rail tankers and as many as 400 highway trucks per day snaking through or near densely populated communities, such as Allentown, Philadelphia, Reading, Scranton and Wilkes-Barre, Pa., and Camden, N.J.

While it’s possible the company could still rely on highway tankers to transport LNG, the number of such trucks would have to be drastically increased to match the volume that would otherwise be carried by rail tankers.

Delaware Currents has previously reported that, even with the special permit in hand, too few of the specialized rail tankers that New Fortress would need to transport LNG exist, there is little interest among manufacturers to build them and they can cost as much as $750,000 per tanker to build.

The project faces other court challenges and other regulatory hoops but one potential hurdle in particular looms largest.

The company and opponents are awaiting decisions by the Federal Energy Regulatory Commission on whether it will assert jurisdiction over the project. If it does, that could set off environmental assessments that could consider the ecological, cultural and human impacts of the project.

That, in turn, could also mean opportunities for litigation to challenge the quality and thoroughness of those reviews – all of which could amount to added time, scrutiny and chances for the project to be delayed or derailed.

In what some interpreted as a signal about the way the commission might rule on the Wyalusing/Gibbstown project, FERC said in March that it had jurisdiction of an unrelated LNG facility in Puerto Rico run by New Fortress Energy.

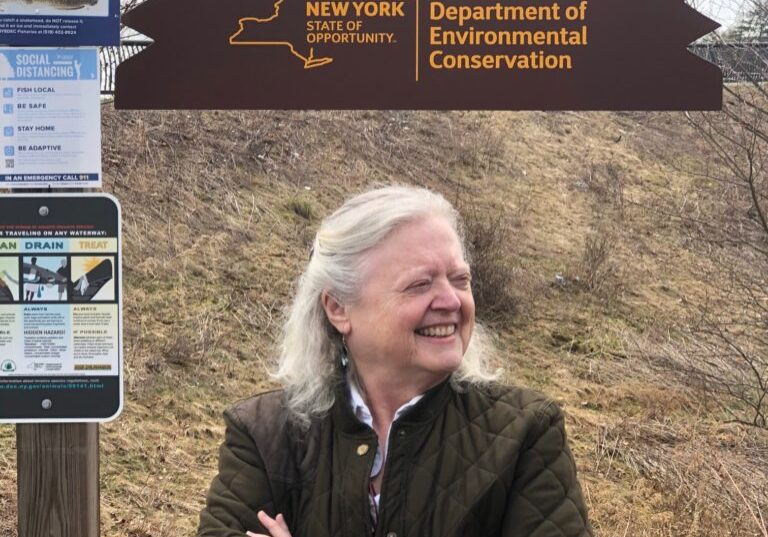

Opponents, including activists with the Delaware Riverkeeper Network, recently rallied in Philadelphia to speak out against the special permit issued by the PHMSA in 2019.

Activists gathered recently in Philadelphia in opposition to a plan to allow LNG trains through population centers such as Philadelphia and Allentown, Pa., and Camden, N.J.

Holding signs in front of the Federal Transit Administration office, activists with the Stop the Bomb Trains Philly Campaign criticized the plan to allow the LNG trains through population centers that activists said would endanger at least two million people.

“A release of the contents from a derailment or other incident in Philadelphia would impact the entire city, with the most intense and inescapable harm in communities populated by people of color and low income,” the Riverkeeper Network said. “Dozens of hospitals, schools, and day care facilities are located along the tracks over a distance of approximately 10 miles in Philadelphia.”

Meanwhile, in a separate action, the PHMSA is looking to suspend a previous authorization that would have broadly allowed liquified natural gas to be transported by rail. Under the proposal, the agency would prohibit LNG to be transported in rail tank cars until a final rule is issued, or June 30, 2024, whichever is earlier.

Federal regulators “understand that rail tank car transportation of LNG is neither occurring nor expected to occur in the near future,” according to a notice about rule.

That proposed suspension does not directly affect the special permit held by New Fortress, however, and would still carve out exemptions for such permits.

“This proposed rulemaking is certainly a step forward in the right direction, although we do not believe that LNG by rail should have ever been authorized in the first place,” said

Bradley Marshall, a senior attorney with the Florida office of Earthjustice, which has fought the LNG-by-rail plan in court.

Carluccio of the Riverkeeper Network called the proposal to suspend LNG by rail “an essential and timely step” but said she was waiting to see the final details.

“We think PHMSA should reinstate the complete ban on LNG by rail and additionally repeal the section of the regulations that allows for special permits,” she said.

![DC_Image [Image 4_Assunpink Meets Delaware] meets Delaware The Assunpink Creek on its its way to meet the Delaware River. The creek passes through woods, industrial and commercial areas and spots both sparkling and filled with litter.](https://delawarecurrents.org/wp-content/uploads/bb-plugin/cache/DC_Image-4_Assunpink-meets-Delaware-1024x768-landscape-14f069364113da5e8c145e04c9f2367c-.jpg)